On 19 September, Technology Connected partnered with Hexa Finance to host an insightful evening event designed to empower entrepreneurs, start-ups, and scale-ups in Wales. The goal was to equip attendees with the essential tools and knowledge needed to navigate the complex world of raising finance, securing investments, and exploring various funding options.

The event attracted a range of business leaders, offering a platform to connect with seasoned professionals in the finance and investment sectors. With expert speakers from across the industry, attendees had the opportunity to learn about the latest trends, challenges, and strategies that can help businesses successfully secure the funding they need to thrive.

Key Highlights

Current Market Outlook:

- Business confidence is gradually returning, though interest rates remain high.

- Wales represents just 3.5% of UK equity investment, a significant gap to fill.

- Baking contingency into your plans is more important than ever.

Debt vs Equity Financing:

- Engage with funders early—securing finance often takes longer than expected.

- Equity finance offers flexibility and expertise, but ambitious growth requires a solid, realistic plan.

- It’s key to know exactly what you need the money for, rather than just taking money for money’s sake.

- Angel investors can offer projects their mentorship and network, which can be of equal or even greater value than the funding itself.

Tailored Funding Solutions:

- Tech businesses can leverage digital assets such as IP and software for finance.

- Angel investors bring both capital and mentorship, so it’s important to consider the value of their time and network as well as the cash itself.

Practical Funding Advice:

- Clear business plans and realistic forecasts are crucial for pitching, flexibility, and negotiation.

- Focus on cash flow, utilise technology for efficiency, and diversify revenue streams.

- Having the right advisors and external perspectives can greatly enhance funding prospects.

The Current Market

A primary topic of discussion was the current landscape of business confidence and the financial market. The discussion also touched on the importance of understanding both debt and equity financing.

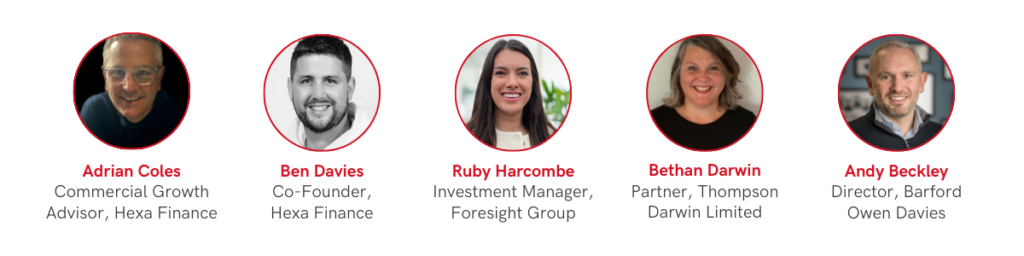

Ben Davies, Co-Founder of Hexa Finance, explained that lenders are increasingly requiring more information to support applications, urging businesses to engage with funders early in the process. He stressed that thorough planning is key to selecting the right financial partner.

A recurring theme across the panel was the importance of a solid business plan, backed by realistic forecasts and a clear articulation of how the business plans to deliver its goals.

Bethan Darwin, Partner at Thompson Darwin Limited, noted that equity finance can provide businesses not only with capital but also with valuable expertise and support – a “group of allies”. Andy Beckley, Director at Barford Owen Davies, underscored this, advising businesses to ensure that any financial plan includes a contingency to balance risk, given the volatile nature of the market.

Exploring Options for Growth

The event also addressed different funding options available to businesses at various stages of growth. Ben Davies highlighted that as businesses grow, particularly after the initial 1-2 years, they often require additional funding to buy stock or invest in resources for the next stage of development. For tech businesses, which are typically asset-light, Ben suggested leveraging intellectual property (IP) and digital assets, such as software, as a means of securing finance.

Angel investors were discussed as an attractive option for early-stage businesses, with Bethan Darwin pointing out that angel investment provides not only capital but also strategic mentorship and support. She emphasised that investors are increasingly interested in women-led businesses, aligning with a philanthropic approach as much as a financial one. Ruby Harcombe further stressed the importance of clear communication and relationship-building with potential investors, noting that transparency and alignment are key to long-term success.

Practical Advice for Businesses Seeking Funding

Throughout the event, the speakers provided practical tips for businesses navigating the funding process. A strong message was that businesses should be clear on exactly what they need funding for, ensuring they do not ask for too little or too much. Andy Beckley highlighted the importance of having a financial sounding board to provide an external perspective on financial plans.

For businesses struggling to secure finance, the advice was to remain persistent and negotiate wherever possible. The panel emphasised the importance of focusing on cash flow and leveraging technology to streamline operations. Diversifying revenue streams was also recommended to strengthen a business’s financial position.

Conclusion

From understanding the right time to engage with funders, to developing a solid financial plan and exploring various funding options, the evening delivered actionable takeaways for businesses of all sizes and stages of development.

We extend our thanks to Hexa Finance for their invaluable partnership in delivering this event, to Adrian Coles of Hexa Finance for chairing the engaging panel, and to all the speakers who shared their expertise. We look forward to continuing to support the business community in Wales through future events and initiatives.

About Hexa Finance

Are you a business seeking funding to fuel your growth and expand your asset base? Or an equipment supplier looking to offer sustainable and reliable financing options to your clients?

Look no further—HEXA Finance is here to help.

The post Event Recap: ‘Back to Business: Raising Finance & Investment’ appeared first on Technology Connected.